|

||

|

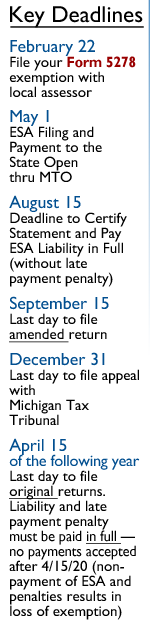

Manufacturers Have Saved $3.4 Billion Since 2016Watch for Upcoming PPT Deadlines and Claim Your Annual ExemptionThis PPT Tool Kit is designed to help you exempt your manufacturing personal property from taxation. MMA is proud of its work to eliminate this tax exclusively for manufacturers through both legislative action and a successful $8 million statewide ballot campaign in 2014. We encourage you to take action and file annually with Form 5278 to get your exemption. It is not automatic — you must file the form every year to be exempt. State Essential Services Assessment — After filing your exemption Form 5278, you are required to pay the State Essential Services Assessment (SESA) by August 15 each year, which is a small assessment used to reimburse local units for essential services like police, fire and ambulance services. FAILURE TO PAY THE SESA CAN RESULT IN LOSS OF THE EXEMPTION. MMA successfully added late payment opportunities out to April 15 of the following year to help manufacturers avoid the loss of the exemption. Beginning in 2020, MMA successfully pushed legislation to eliminate the late payment “death penalty” for the SESA. Instead of an immediate loss of the full exemption, payments made after the annual August 15 deadline are subject to a 3% per month penalty up to a maximum of 27%. Loss of a company’s full exemption only occurs if payment is not made as of April 15 of the following year. This tax cut does not occur automatically. You must annually file Form 5278 by Tuesday, February 22, 2022 (postmark accepted) and submit SESA statement and payment by August 15 (to avoid penalties). The PPT Savings Tool Kit — Understanding the Exemption ProcessThis Tool Kit provides you the information and resources to ensure your company takes the appropriate steps to receive this substantial savings. Reference the tabs along the top of the page to access different parts of the Tool Kit. Follow the instructions and it will yield substantial property tax savings for your company. |

|

|

| ||