|

||

|

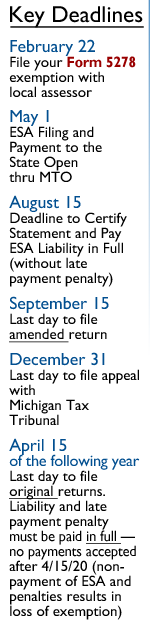

Essential DeadlinesThe exemption process includes several steps with specific deadlines to achieve the exemption. We encourage you to become familiar with the required filing deadlines. These include the annual local filing on February 20, and the payment of the Essential Services Assessment by August 15 of each year. Failure to meet deadlines can result in the loss of the exemption, so it can be a very expensive error. February 20 each year, or February 22 for 2022 — File exemption with your local assessor Taxpayers wishing to claim the exemption must file a Michigan Department of Treasury Form 5278 with the local assessor by Monday, February 20, each year, or February 22 for 2022. The form will not be considered filed unless it is:

(Late filing of the Form 5278 may be sent directly to the local March board of review prior to its final adjournment. This appeal process was drive by MMA-led legislation signed into law in 2017) August 15 — DUE: SESA Statement and Payment to the State in fullIn order to file and pay the SESA, taxpayers may register on Treasury’s web portal, Michigan Treasury Online (MTO) or file by e-file and pay through e-file or ACH (see Resources tab for more). The deadline for the filing of the SESA statement and payment is August 15. If payment is not made by August 15, late payment penalty accrues at 3 percent per month up to a maximum of 27 percent of the amount due and unpaid until April 15 of the following assessment year. Access the Michigan Department of Treasury. April 15 (of the following year) — Last day to file and pay tax and penaltyThis is the final deadline the SESA must be paid in full before the tax exemption is rescinded. This means losing your exemption for that year. Note: If there is an extended IFT or P.A. 328 and SESA is not paid in full (including late payment penalty), Treasury will request the STC rescind the extended IFT or P.A. 328. |

|

|

| ||