Michigan Manufacturing Labor Market Update

The manufacturing labor market in Michigan is a critical sector that significantly contributes to the state’s economy, with a particular focus on the automotive industry. A Cushman & Wakefield and US Bureau of Labor Statistics analysis of recent demographics offers insights into current trends and future projections in key metropolitan areas, including Detroit, Kalamazoo and Grand Rapids.

The manufacturing labor market in Michigan is a critical sector that significantly contributes to the state’s economy, with a particular focus on the automotive industry. A Cushman & Wakefield and US Bureau of Labor Statistics analysis of recent demographics offers insights into current trends and future projections in key metropolitan areas, including Detroit, Kalamazoo and Grand Rapids.

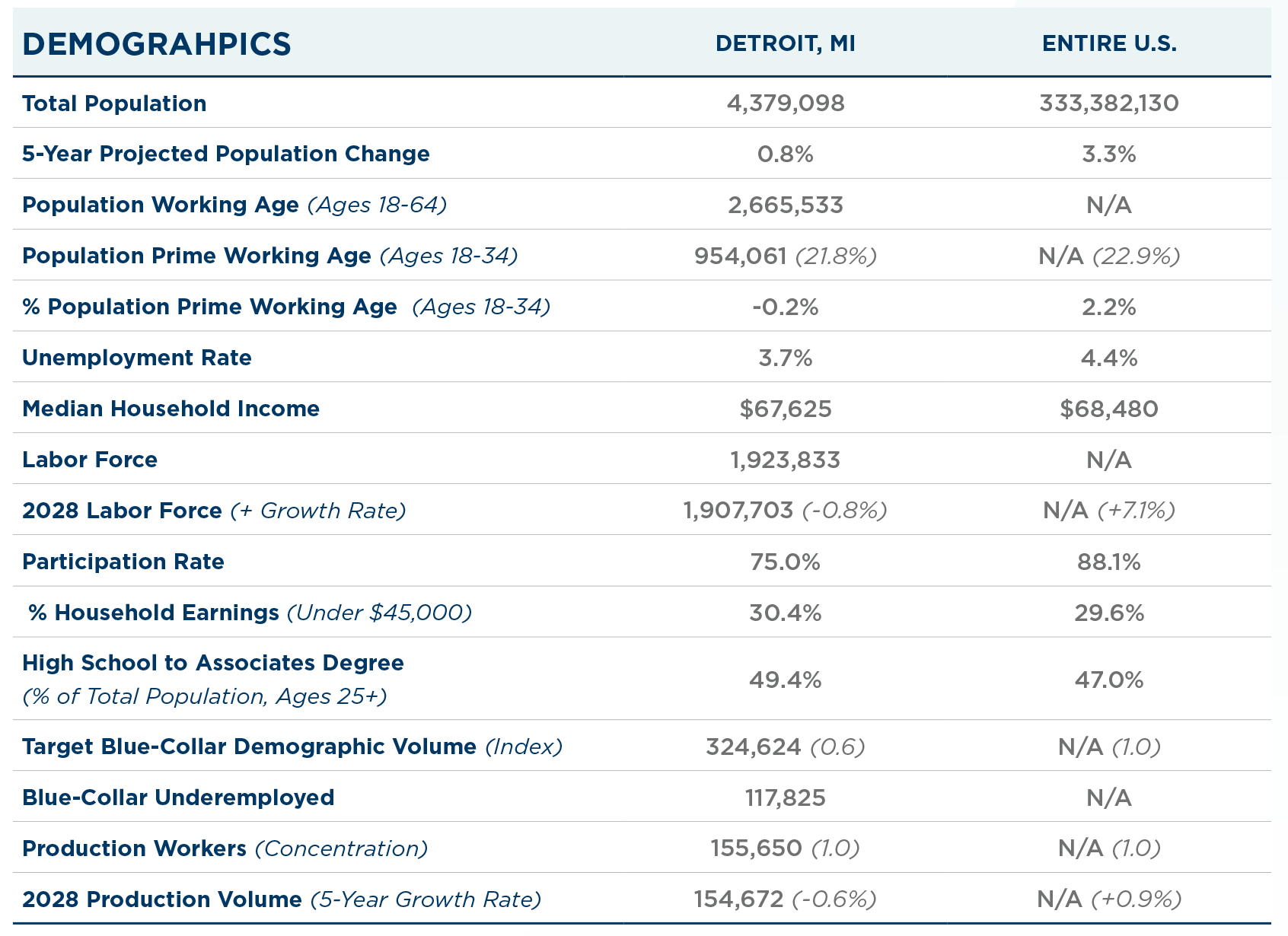

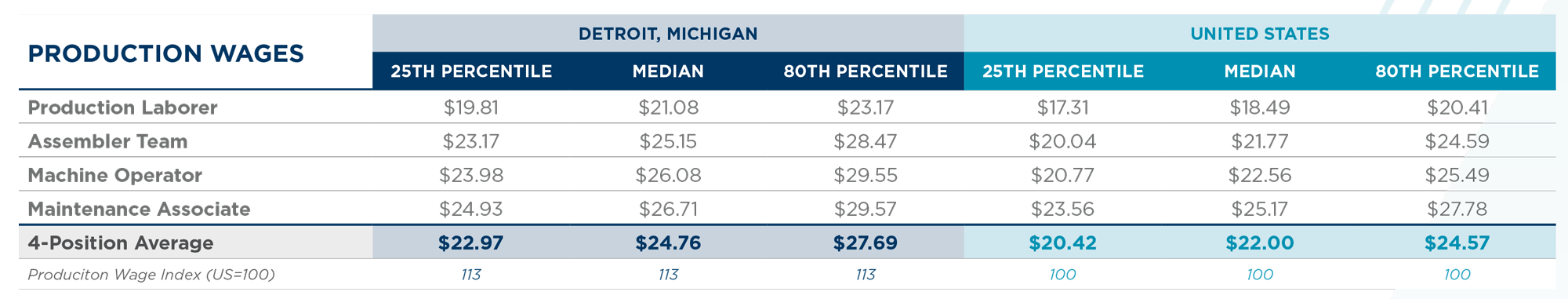

As the hub of the U.S. automotive industry, metro Detroit has traditionally been the backbone of Michigan’s manufacturing workforce. The region has a total population of over 4.3 million, with a modest projected growth of 0.8 percent over the next five years. Of the 4.3 million population, the labor force represents a total of 1.9 million. Despite this demographic challenge, the median household income in Metro Detroit stands at a robust $67,625. An analysis of average hourly wage rates for entry to mid-level manufacturing workers (i.e. machine operator, assembly team) showed that wages paid to Metro Detroit workers are 13.0 percent higher than the national average. Interestingly, the projected growth rate for the labor force in 2028 shows a decrease of 0.8 percent, potentially signaling a tightening labor market or shifts in economic dynamics.

In contrast, Metro Kalamazoo, although much smaller in population, shows a stable working-age demographic and an impressive 81.9 percent participation rate. The median household income is lower than Detroit’s at $63,352 but the area has a projected labor force growth rate of 0.1 percent, indicating potential for expansion. Moreover, Kalamazoo has a significant concentration of skilled labor, with 45.8 percent of its population holding an associate degree or higher, making it an attractive locale for specialized manufacturing roles.

Metro Grand Rapids presents an optimistic picture with a 2.3 percent projected population growth and an increase of 1.2 percent in the population of prime working age. This metropolitan area stands out with the highest median household income among the three at $73,980, accompanied by a positive labor force growth rate of 0.8 percent. Grand Rapids has a particularly high labor participation rate of 85.6 percent, suggesting a highly engaged workforce. Additionally, the percentage of households earning under $45,000 is the lowest among the metros at 26.1 percent, further indicating a relatively affluent and potentially more stable workforce.

Across the state of Michigan, the percentage of “blue-collar” workers as a percentage of the labor force is significant, with roughly one out of four workers considered as blue-collar. These figures underline the importance of manufacturing and related industries in these regions. Notably, the projected growth rate for blue-collar workers is somewhat stagnant or declining, with Detroit seeing a slight decrease. This could be indicative of automation, outsourcing or changes in industry demand impacting blue-collar job availability.

One concerning trend across Michigan’s manufacturing labor market is the negative growth rate in production workers, a key component of the blue-collar demographic. Metro Detroit and Metro Kalamazoo both see a 0.6 percent and 1.0 percent decrease, respectively. This suggests that manufacturing employment opportunities might be shrinking, or there is a shift toward higher-skilled manufacturing roles that require advanced training and education.

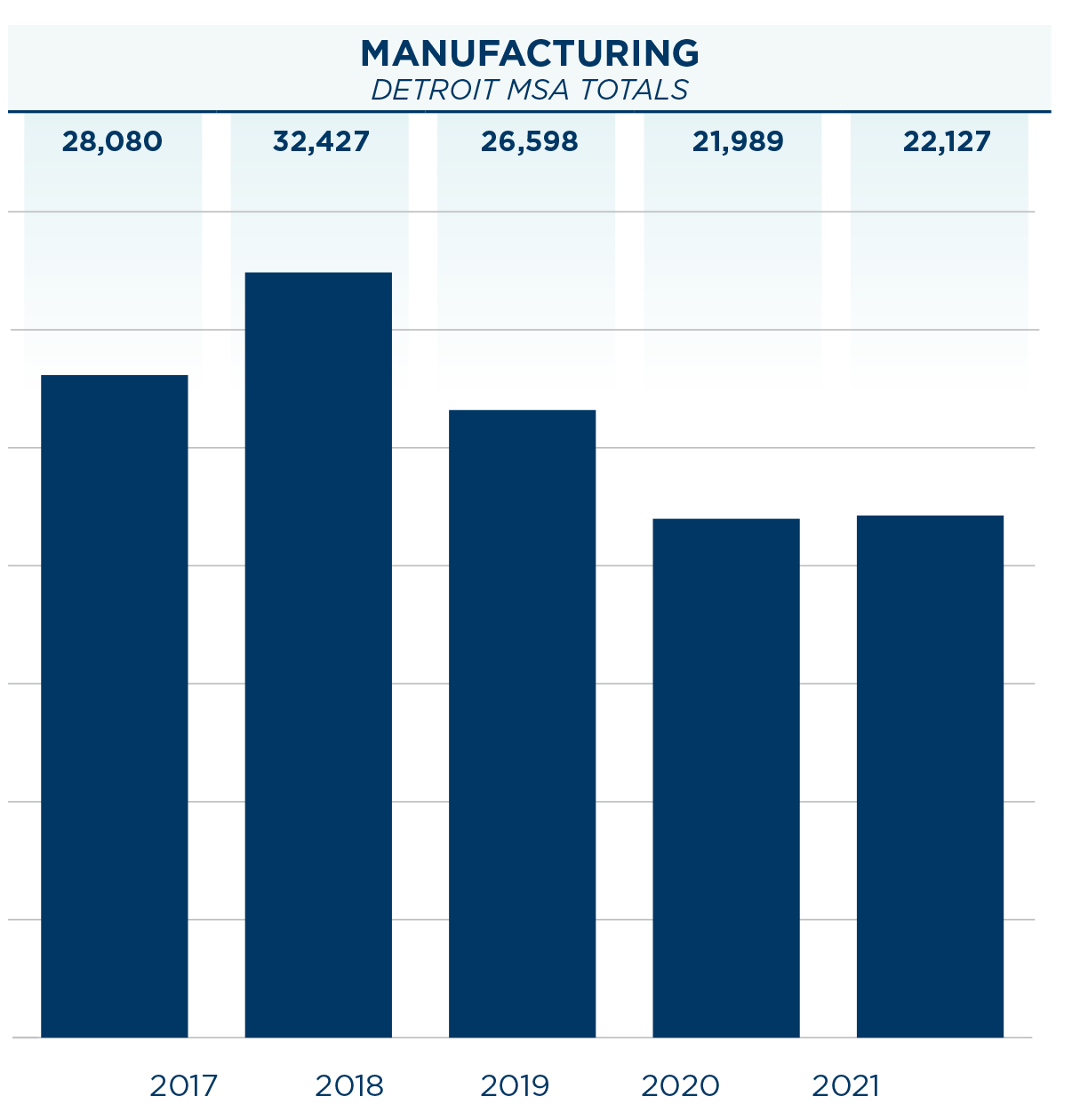

Manufacturing migration refers to laborers from outside industries transferring into manufacturing-related employment opportunities. Based on data from the U.S. Census, Michigan’s manufacturing migration from the years 2017-21 shows a peak in migration in 2018 with 79,840 individuals, followed by a significant drop in 2020, likely due to the impacts of the COVID-19 pandemic, to 53,742 individuals, indicating a fluctuating but generally downward trend in manufacturing migration over these years. Over the five-year trend, a total of 331,127 jobs were added to the manufacturing industry within Michigan, with a large majority of employees coming from Administrative and Support and Waste Management and Remediation Services.

In conclusion, the manufacturing labor market in Michigan’s major metros presents a mixed outlook. While there are signs of a stable and potentially growing workforce in Grand Rapids and Kalamazoo, Detroit’s manufacturing sector seems to be facing headwinds with a declining labor force and a decrease in the number of production workers. It is crucial for policymakers, educators, and industry leaders to closely monitor these trends and invest in workforce development and education to ensure that Michigan remains competitive in the evolving manufacturing landscape. Efforts to attract young talent, upskill the existing workforce, and enhance the technological capabilities of manufacturing operations will be key to the long-term vitality of Michigan’s labor market.

About the Authors

Cushman & Wakefield Research Manager Jarrett Hicks and Research Analyst Edgar Bravo contributed to this article.

Kyle Passage is a Senior Associate with Cushman & Wakefield. He may be reached at kyle.passage@cushwake.com.

Kyle Passage is a Senior Associate with Cushman & Wakefield. He may be reached at kyle.passage@cushwake.com.

Cushman & Wakefield is an MMA Associate Member and has been an MMA member company since January 2024.

Cushman & Wakefield is an MMA Associate Member and has been an MMA member company since January 2024.